AMP8 has presented some challenges for water companies, and recent events in the UK are certainly throwing up some short-term issues for water supply in certain regions, but generally water companies have these events well in hand and the scaremongering in some of the UK’s more dramatic media outlets can be broadly ignored. However, some of these recent events pose a significant long-term risk to our industry as we move towards Price Review 2024 (PR24), and water companies should take note of the perfect storm which will be heading their way in AMP9.

This article will explore some of the challenges which are facing the UK industry over the next few years and look at how they could come to a head as companies attempt to gain approval for their AMP9 business plans to be submitted for initial review next year.

Climate change and extreme weather events

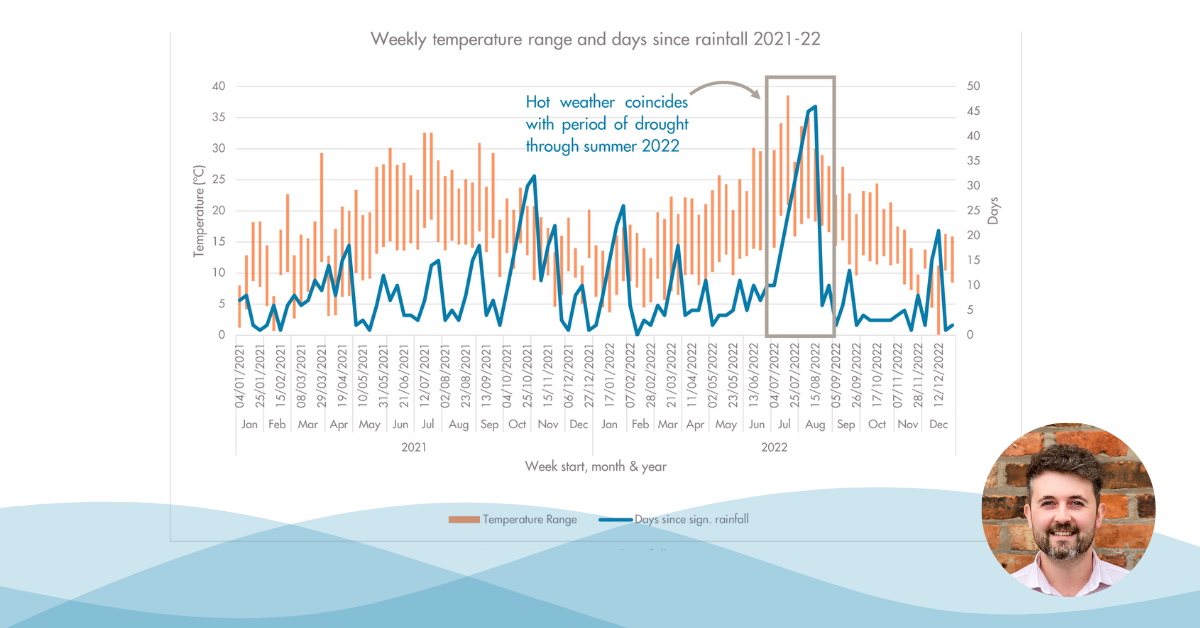

A MET Office report recently highlighted that the UK has seen both its highest temperature and driest July on record this year (Driest July in England since 1935, by The Met Office). Extremely hot and dry weather conditions like this hit water companies from two sides, with customers taking more water from their distribution networks, and a reduction of capacity within water sources affecting the amount of potable water they can produce.

To add to their woes, rainfall in the UK has been increasingly concentrated into shorter periods, causing flooding and significant ground movements when rain finally does come. This causes problems for customers directly as well as water companies’ distribution networks which can burst as a result, particularly in clay soils.

With this trend towards more extreme weather events expected to continue, we can expect these challenges to get worse in the next AMP. Water companies need to think about how they balance risk and prepare for events on a scale that the UK has never seen before, not an insignificant challenge.

Restrictions to water resources

Understandably, the Environment Agency have been pressing water companies to reduce their reliance on abstraction from water sources where it is causing a detrimental effect on the environment, particularly river abstraction sources in the South East of England. In their Meeting our Future Water Needs: A National Framework for Water Resources report in 2020, the Environment Agency stated: “Our modelling assumes that around 700 million litres per day of water that comes from unsustainable abstractions will need to be replaced by other means between 2025 and 2050.”

In many cases this forms a fixed deadline for reducing abstraction, with licenses being revoked or removed in line with these timescales. At a time when demand is increasing and alternative water sources are not properly tested against modern climate change considerations, this might create localised supply shortfalls in AMP9 as water companies still try to manage increasingly unpredictable demand events.

If water companies are unable to deliver on their demand and leakage reduction plans, they may be stuck between the proverbial ‘rock and a hard place’ as their water sources slowly disappear and, in many cases, are replaced by more expensive solutions, such as desalination.

Inflation and increased costs

The UK is currently going through a cost of living crisis, with energy costs expected to rise again significantly this winter. Again, this is a multi pronged attack on water companies. Firstly, their own costs of operating are rising, including water treatment, pumping and increased wage demands from their staff. Secondly, their customers’ ability to pay their bills are also reduced, leading to a cash flow risk for water companies. And finally, the real value of the revenue they do receive is reduced, affecting their operational activities.

Fortunately, there is a metric within Ofwat’s ‘PR19 Reconciliation Rulebook’, which governs how water companies reconcile their performance with their PR19 commitments. This allows water companies to adjust revenue based on inflation, effectively enabling them to increase customer prices. However, this uses a November to November lagged measure to set prices for a forthcoming financial year. In effect, this means that water companies, who probably won’t have anticipated our current recession last year, can’t react until November 2022, when they can decide on changes to bills to come into effect in April 2023. Inevitably this will result in an over increase of prices to account for both future risk and this year’s lost revenue.

Public mood towards private utility companies is already at a low, with gas and electricity providers posting record profits while customers struggle to meet bills (BP profits triple to £7bn as oil prices surge because of Ukraine war, The Guardian). Any increases will hit customers hard on the back of a tough winter of high fuel costs, at a time when their water consumption will be increasing, and it is easy to see the public lumping profitable UK water companies in with the fat cats of the energy sector. With recent media articles quick to highlight our own industry profits, this perception may already be starting to form in customers’ minds e.g. Anglian Water pays £92mn dividend to owners as customer bills rise, by The FT.

Wider public perception

The UK industry has been in the media for a lot of the wrong reasons over the past few months, with the papers launching an all-out propaganda assault using some emotive subjects. The recent Independent article Oxfordshire village runs out of water as lethal heatwave looms is indicative of the media trend, being heavy on the hyperbole and light on detail. You may be interested to know that further reading identifies that 68 customers were temporarily without water, not great but not an unusual occurrence in the UK, and, despite the lethal heatwave, none of them seem to have died as a result.

Other similarly dramatic articles such as Water companies ‘sold off reservoirs that could have eased drought’, by The Telegraph, effectively accuse water companies of incompetence and putting shareholders ahead of customers. Further investigation identifies that the majority of the reservoirs referenced in the article were actually smaller clean water service reservoirs, which would do nothing to alleviate pressures on water sources caused by the drought. Without an understanding of the difference, it is easy for the reader to be drawn in by the headline and cover photo of an impounding reservoir and come the dramatic conclusion the author intended.

Our water companies are not flawless, but this level of misdirection from two supposedly reputable media sources doesn’t help the industries valuable relationship with its customers.

Identifying customer priorities

As part of PR24, Ofwat has introduced a new approach of ‘collaborative customer research’, aiming to implement centralised research into customer perceptions and priorities for water companies in the next AMP, replacing the individual engagement undertaken by water companies. Judging from their last steering group presentation in July, they are currently developing an approach to test customer affordability and acceptability of water companies’ business plans. Water companies are complex beasts, with high levels of technical consideration going into their operations, and it is difficult to communicate this to a customer and expect them to fully understand how realistic their own priorities might be. So, whilst this makes perfect sense from Ofwat’s perspective, allowing better transparency and accountability, it will inevitably remove some of the ‘wiggle room’ afforded to water companies to interpret what their customers say they want against what they actually need.

Presumably this engagement will be implemented after initial submission of business plans next year and will land with customers as bills rise. The timing of these events could create a challenging environment for the acceptance of any business plans which contain realistic strategies to target some of the challenges the industry is facing.

In summary

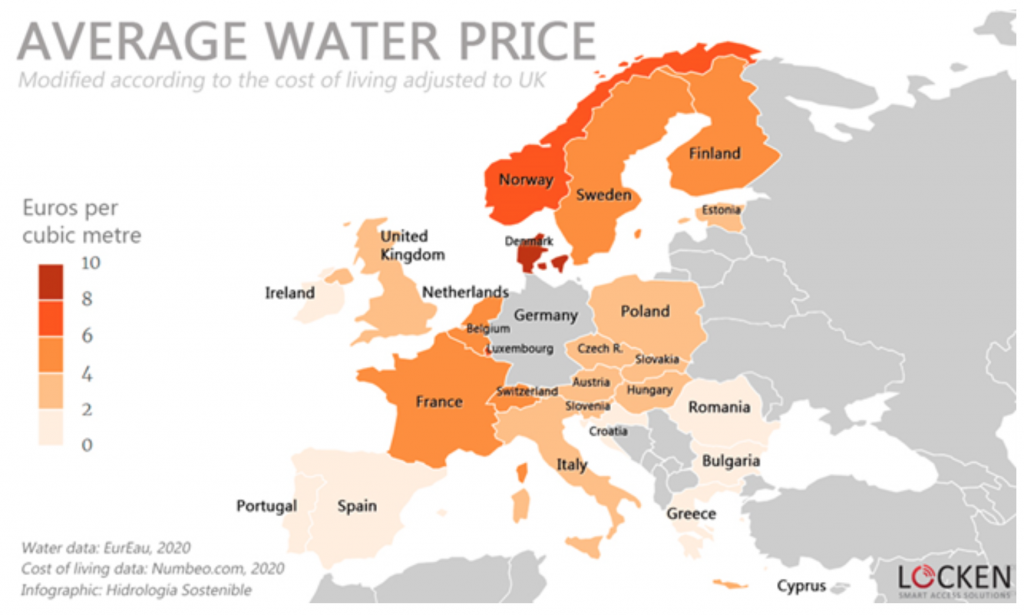

For a long time the UK water industry has provided exceptional value to its customers. The graphic below, from a Smart Water Magazine article in 2020, shows the relative cost of water in the UK compared to our European Neighbours. It is clear to see that we are delivering significant value compared to some of our Northern European neighbours, where prices are typically over double those in the UK.